Credit: Visual China

BEIJING, July 28 (TiPost)— Chinese auto manufacturer Great Wall Motor (GWM) announced on Thursday that its new Tank 500 model was launched in Kazakhstan.

(相关资料图)

(相关资料图)

The Tank 500, a fuel-powered flagship SUV, has entered Middle Eastern markets such as the UAE and Saudi Arabia this year. A person familiar with Kazakhstan"s automobile market said that in this oil-producing country, the local cars are mainly fuel-powered as a result of low gasoline prices.

Kazakhstan is the largest automobile market in Central Asia with annual sales of more than 100,000 units. In 2014, Anhui Jianghuai Automobile Group (JAC Motors) took the lead in entering the Kazakhstan market as the first Chinese automobile company, followed by GWM In April 2021.

The leading state news agency Kazinform reported on Monday that the country’s domestic new car sales were 66,300 units in the first five months of 2023, up 65.8% year-on-year. The top three brands are Chevrolet, Hyundai, and Kia, and five Chinese brands are among the top ten sales list, namely Chery Automobile, Haval Automobile (a sub-brand of GWM), Exeed (a sub-brand of Chery Automobile), Changan Automobile and JAC Motors.

The Chinese auto brands came to prominence in Kazakhstan market in 2022, as a result of the withdrawal of some European and Japanese models produced by the Russian factory and also the accelerated production of the Chinese local brands, according to Kazinform.

Due to Central Asia"s weak automotive industry, it is the traditional car companies with strong supply chains of their own that can exploit the Central Asian market, said Qi Xuefan, a senior consultant of EFS Consulting.

In May 2019, JAC Motors and China National Machinery IMP. & EXP. Corporation (CMC) signed a contract for the joint acquisition of 51% Kazakhstan’s Allur Group, the largest automobile industry group in Kazakhstan. JAC Motors and Allur Group began their cooperation in 2014 to locally assemble and produce JAC models for Kazakhstan and neighboring countries.

GWM signed a memorandum of intent for KD assembly cooperation with Astana Motors, its Kazakhstan partner in September 2022, in an attempt to be more locally competitive and further activate and release the potential of the local automobile market.

In addition, Chinese carmakers face cut-throat competition in some overseas markets, such as Southeast Asia and Latin America. Therefore, the moderate Kazakhstan and Uzbekistan markets with few local automotive brands attracted the attention of the Chinese automakers.

As the second largest auto market in Central Asia, Uzbekistan has become a key focus for Chinese car companies.

In December 2022, BYD and Uzavtosanoat JSC (UzAuto), a Central Asian automaker announced the signing of an agreement to establish a joint venture company producing new energy vehicles (NEVs). The new joint venture company, which mainly manufacture BYD models, is based in Uzbekistan. In July 2023, GWM launched its models in the Uzbek market, and would cooperate with the local ADM automobile factory to realize localized production.

GWM sold 519,000 units new cars in the first half of 2023, up 0.14% year-on-year, which is hardly optimistic considering the low base caused by the pandemic over the same period of 2022. The carmaker’s exports in the first half of the year amounted to 124,000 units, a prominent year-on-year increase of 97.27%.

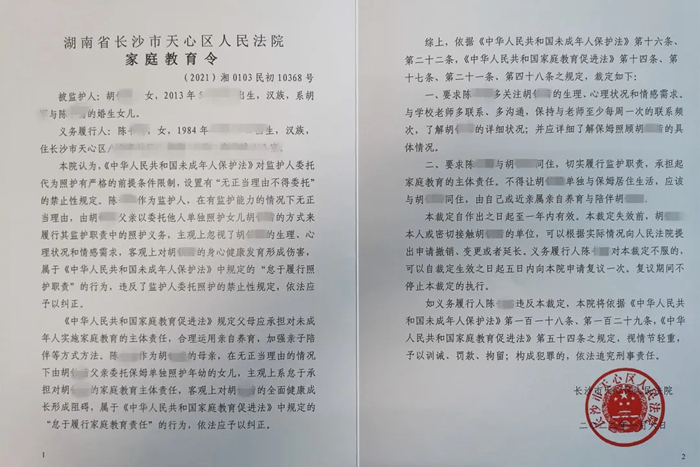

检察官担任法治副校长有了“指挥棒”

检察官担任法治副校长有了“指挥棒” 全国首份《家庭教育令》来了!督促家长“依法带娃”

全国首份《家庭教育令》来了!督促家长“依法带娃” 俄军装甲车辆将具备隐身能力

俄军装甲车辆将具备隐身能力